There is no faster growing industry than the Canadian cannabis industry. We are here to share our knowledge and help make the insurance process simple for your cannabis business.

Since cannabis was legalized in Canada in October 2018, licensed producers in Alberta have been required to hold no less than $10 million in general liability insurance. The Alberta Gaming, Liquor and Cannabis Commission (AGLC) recently updated their requirements with new minimum limit options for different license classes. The limits for commercial general liability are:…

You’ve decided to apply for your retail cannabis license – now what? You are most likely on the hunt to secure the right location for your business. This is also the time when you will want to start looking at your insurance options. At a minimum, this would include commercial liability (CGL), but depending on…

Canada’s licensed outdoor cannabis cultivation space has increased from 19.9 million square feet at the start of 2020 to 59 million square feet since Health Canada’s latest report in August. Outdoor growing is an attractive option for cannabis businesses since the operating and start-up costs are typically lower than growing in greenhouses or indoor warehouses.…

Cannabis sales have been rising month-over-month this year, accelerating since the COVID-19 pandemic was declared in March. As of July 2020, Alberta has the second highest cannabis sales in Canada, following behind Ontario. By the end of this year, Alberta’s legal cannabis sales are expected to reach $540 million. This reflects the fact that Alberta…

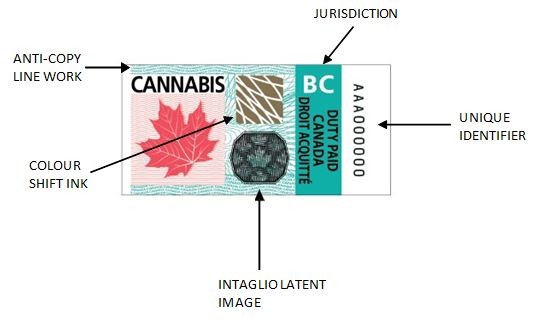

Image rights: Canada Revenue Agency Becoming a licensed producer or other cannabis licensee in Canada can already be a complicated process. Cannabis excise stamps are government-issued stamps that need to be pasted onto cannabis product packages prior to sale in Canada. Excise stamps confirm that the producer has paid the federal excise tax to the…

“To further contain the spread of the novel coronavirus COVID-19, provincial governments across Canada have ordered the mandatory closure of all non-essential businesses and services. One industry that is exempt from the mandatory closures, and therefore deemed essential, is the cannabis industry. All licensed cannabis producers and stores have so far been allowed to remain…

Author: Insurance Business Canada IBC: How have you seen the insurance market for cannabis risks evolve since recreational use was legalized? Kevin Lea: The market for cannabis insurance in Canada has been slowly evolving since legalization. We’ve seen the continued strength of the MGAs and other wholesalers generally dominating the sector, similar to the way it…

Canada’s legal cannabis market is highly regulated, putting it under the microscope for any products that fall short of these regulations. Product recalls are issued when a license holder or Health Canada becomes aware that there may be a health or safety risk present in a cannabis product or if the product does not meet…

Canadian cannabis companies should be thinking strategically about future expansion into some of the larger markets, such as Europe and the United States. Although doing so won’t come without insurance implications. “We are certainly seeing some complexities there. Some of our clients and other companies within the industry are looking to do cross-border operations,” said…

Final regulations were released by Health Canada on June 14th for the next wave of cannabis products including edibles, extracts, and topicals, which will come into effect on October 17th this year. It didn’t come as a surprise that Health Canada has made protecting public health and safety its top priority in their final regulations.…